Episode 93:

Healthcare's Legal Tightrope: Navigating Physician Contracts

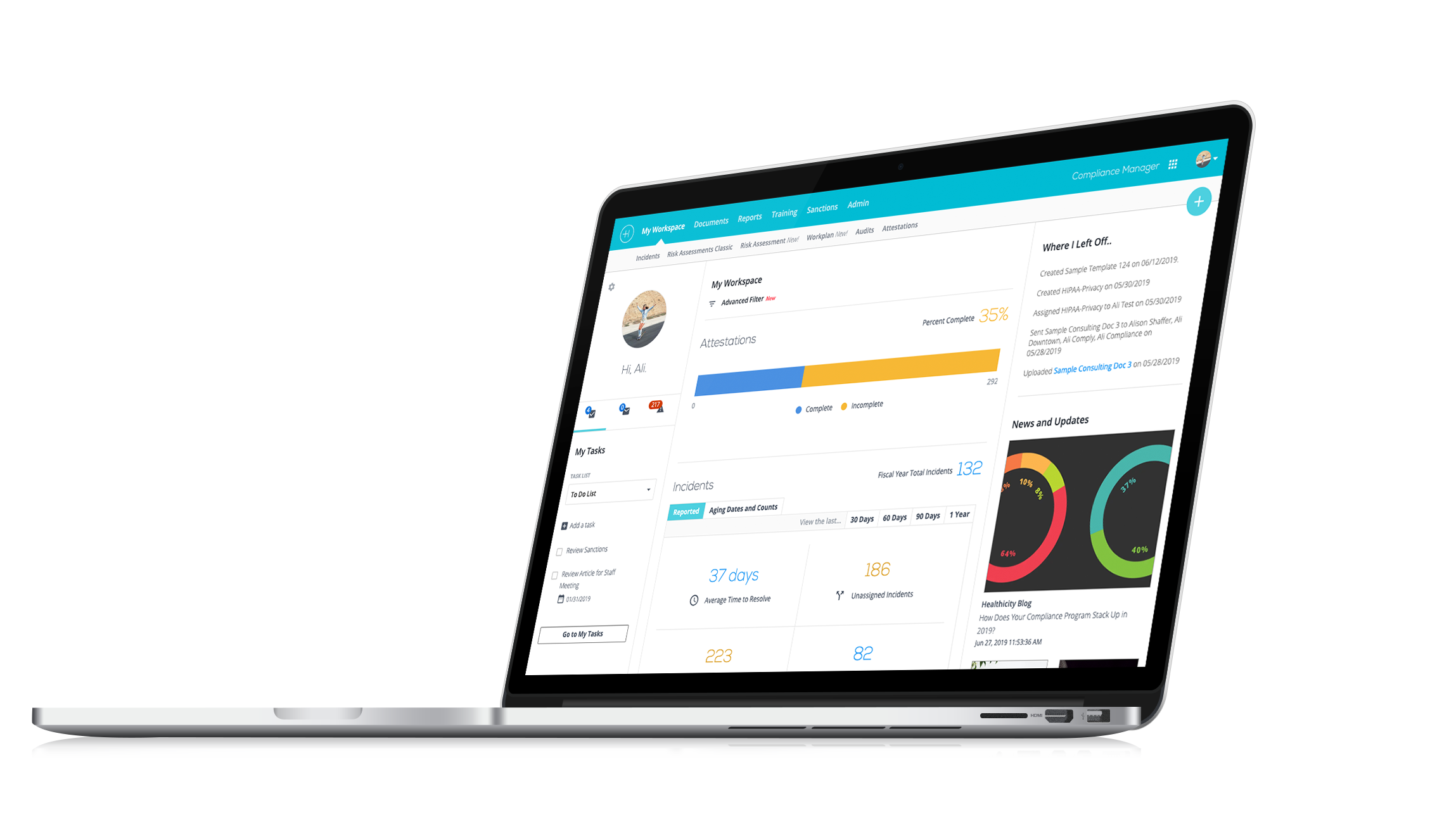

Watch the demo:

Compliance Manager

See the only all-in-one compliance solution today.

Discover expert insights and practical tips on navigating the complex world of physician financial relationships in this Compliance Conversations episode with Hal McCard.

In this episode, we welcome back Hal McCard, Counsel at Spencer Fane, to delve into the complexities of financial relationships with physicians, including essential insights on compliance with STARK and Anti-Kickback statutes.

CJ Wolf, MD, and Hal McCard discuss:

- Hal’s extensive career in healthcare law and his journey to becoming a leading expert in the field.

- Detailed explanations of STARK and Anti-Kickback statutes and their implications for healthcare organizations.

- Practical advice on maintaining compliance in physician contracting, from fair market value documentation to auditing processes.

- The importance of centralized arrangements tracking systems and how they can help mitigate compliance risks.

- Real-world examples and valuable insights from Hal’s experiences as in-house counsel and external advisor.

Check out the episode to gain valuable knowledge and practical tips to enhance your compliance programs and safeguard your organization against potential pitfalls.

You can also check out the webinar Hal co-hosted with Brian Burton, Healthicity’s Chief Compliance and Privacy Officer, on the separation of legal and compliance.

Interested in being a guest on the show? Email CJ directly here.

Episode Transcript

CJ: Welcome everybody to another episode of Compliance Conversations. My name is CJ Wolf with Healthicity and today we're going to be talking about some important compliance topics, about financial relationships with physicians and all that is entailed therein. And our guest is Hal McCard, welcome Hal to the show!

Hal: Thanks so much, CJ, I appreciate it! It's an honor to be here.

CJ: Well, we appreciate you taking the time and your expertise and experience in this area. But Hal before we jump into our topic, we always give our guests an opportunity to share a little bit about themselves, maybe tell us how you got where you are professionally and what you're doing or anything that you're comfortable sharing in that regard.

Hal: Sure, absolutely. I've been practicing in healthcare law for over 25 years. It was something that I always wanted to do, even as a young attorney, and I've been able to follow that throughout the course of my career. I'm currently practicing in Nashville, TN. I'm counsel with the law firm of Spencer Fane, which is a large national firm with a robust healthcare practice. Prior to that, I was General Counsel of Quorum Health Corporation, which was a publicly traded New York Stock Exchange-listed company, here in here in Nashville or in Brentwood, more accurately. And before that I was Deputy General Counsel of Community Health Systems, which is located in Franklin, TN where I practiced in the in-house legal department for since about 2007. We moved up here from New Orleans, where I ran the healthcare practice of a law firm in New Orleans and part of that we're in Atlanta where I was General Counsel of a behavioral system in the Atlanta area. So, a lot of experience in the healthcare field, and just delighted to have a few minutes to share with the audience today.

CJ: Yeah! Well, thank you, Hal! That's a great background. And if you don't mind me saying, I believe you also co-hosted a webinar with Healthicity's chief compliance officer recently.

Hal: Yeah, with Brian. Yeah! Brian and I go back away as we go all the way back to community health systems and also to the Forum Health Corporation, where he was our compliance officer. So, he and I worked very closely and very collegiately together for a number of years and just have a great admiration for his knowledge and his experience and what he does. So, he's such a valuable addition I think to the Healthicity team he's just a phenomenal person and a phenomenal compliance professional.

CJ: Yeah, I enjoy working with him as well. And so, for our listeners, if you're interested, that webinar is on demand, I believe you both were speaking about kind of the role of legal and compliance and how they work together and when they should be a little bit more independent and that sort of thing, right?

Hal: We were, yeah, we were glad it was centered around exactly that topic and also the general compliance program guidance that OIG issued in November. We were, both of us were glad to get some sort of clear direction from a very important enforcement authority and some insight into what they're thinking was as to how compliance program should be structured, what the element should be, what areas they should cover, and what OIG was looking for on behalf of HHS in terms of how they view the landscape of compliance. So, it was a great opportunity to talk a little bit about one of their observations in terms of the separation of legal and compliance and structuring a robust compliance program.

CJ: Yeah, so all of you that want to listen to that a little bit more in-depth that is on demand you go to the Healthicity's web page, and they have a resources page and you can search by webinar and topics, and those sorts of things. So, thank you for doing that as well, and our topic today as I mentioned is financial relationships, and maybe we just kind of start have you set the stage a little bit, what are some of these main risks areas in forming financial relationships with physicians and of course that will probably lead to you telling us about STARK and AKS and what those are all about.

Hal: Yeah, absolutely. I don't know if there's any topic, there may be one or two, I don't know if there's any topic that keeps in-house lawyers and compliance professionals up at night quite as much as physician compliance and contracting compliance and compliance with various other elements that we'll talk a little bit about. I had a colleague of mine who once remarked that he didn't think there was anything more dangerous than paying money to a physician and the healthcare arena these days. And kind of when you think about it, I kind of have to agree with them. It's just fraught with peril and it gets a lot of attention, I think from both legal and compliance in terms of how we're going to make sure those relationships remain in compliance between the hospital and the doctor.

Probably the two main drivers as you alluded to earlier are the STARK regulations, STARK law, and regulations which OIG and its guidance refer to as the physician self-referral law and the Anti-kickback statute are probably the two that get the most attention on the STARK side because it's such a technical regulation and there several exceptions available. Just to review it, the STARK law forbids a physician from making a referral for certain designated health services that are payable by Medicare to an entity with which that physician has a relationship either compensation, ownership, or investment, unless that relationship meets one of the exceptions, the two most common being employment and the and the PSA exception, which is the professional services exception. Those are the two probably that we see the most in their arrangements between hospitals and physicians. But there are other things as well, you know, the kickback statute forbids anyone from offering or paying or soliciting remuneration, which has a huge, hugely broad definition, almost anything can be remuneration. As I remind people to induce people or in return for referring an individual for furnishing services that are payable by federal healthcare programs, a little bit broader in terms of its payer reach, purporting to cover all federal healthcare programs versus a little bit more limited scope on the STARK side, but it's a hot topic. It's something that OIG addressed in the general compliance program guidance. They paid attention to it in looking at financial arrangements and in some of their comments and if the listeners are interested this occurs around page 80 of the guidance, it's near the very, very end of the guidance under the other compliance considerations, but they say specifically that it's very important that these relationships be monitored and they refer to it as financial arrangements tracking, and I agree with them that there needs to be a robust compliance approach to these in terms of auditing and tracking and how do we go about doing that, we all remember from the first iterations of the STARK law that them referring to a central database of arrangements and things like that OIG takes it a little bit further and provides a little bit more color on that and refers to it as a centralized arrangements tracking system. They have some language in there that indicates that it's scalable. I mean if we're a small organization, we can do things that are appropriate to be in a small organization, bigger organization might approach it differently, but they do place importance on a centralized arrangements tracking system. They don't tell you straight up front, you got to go out and buy software. So, depending on our budgets and budgets are always a consideration. I'm not suggesting that they're telling us we need to go and purchase software, it can be done in a number of different ways, but I do think the bias is towards automation. And the reason for that is simply the availability of the documents, the physician employment contracts, or the PSA arrangements in a centralized place with some sort of audit function where tracking can be done for expiration of the agreements themselves or refreshment of fair market value studies that support the arrangement. And also, routine checks for other issues because as we focus on the STARK and the Anti-kickback compliance, we don't want to forget these physician relationships have a number of other dimensions to them, there can be medical staff issues that arise that might implicate the national practitioner databank and licensure actions. They're certainly exclusion monitoring, which we're doing up front with the list of excluded individuals and entities exclusions list. And also, open payments I don't want the listeners to forget about the Open Payments database which tracks financial relationships between certain providers, teaching hospitals and pharmaceutical and medical device companies.

So, there are a bunch of different dimensions to these relationships, not only STARK Anti-kickback, but I think it's important for folks to remember that the tracking and auditing of those relationships on a regular basis is what's going to really help out.

CJ: That I think hit so many important points there. You know, as you were talking about the tracking systems, if you look at and these are publicly available, right? some of the corporate integrity agreements after you've seen some of these headlines where organizations either settle for allegations of violating STARK and Anti-kickback issues the corporate integrity agreements will often have those requirements in there and they spell out in even greater detail than we've just discussed what's required in tracking those relationships and so that might be another place for folks to look. Do you find that that is good general guidance as well, looking at those corporate integrity agreements?

Hal: Yes, absolutely there are a rich, rich sort of teaching environment for things and it's easier or it's beneficial in a lot of cases to learn from other people's mistakes. And I think that those CIAS in particular provide a really, really great resource to understand what went wrong for someone else's organization and then to be prepared to take action to make sure that those same sorts of things don't happen to you.

CJ: Yeah, and you know, you also gave a nice overview of STARK and correct me if I'm wrong I'm not an attorney, but sure you've played with a lot of them, but STARK is a strict liability statute, meaning you don't have to have intent, if I understand it correctly. And so, you have to dot the I's and cross the T's, you have to meet all the requirements, whereas my understanding Anti-kickback statute is intent based. You could still make a lot of mistakes there, but just kind of two different playgrounds on the same set of toys, if you will, right?

Hal: Yeah! Absolutely correct. With STARK you're either in the exception or you're not in the exception. And as you know, I mean that, yeah, it's literally a checklist of requirements for the professional services, arrangements and employments, it's a little less prescriptive in terms of its checklist of requirements, but you're either in the exception or outside the exception if you're outside the exception, you're likely in violation and subject to the overpayments liability as well as per claim liability and then overall penalty which they can assess which I think is still $100,000 for a non-compliant scheme. So yeah, it's STARK, it’s a great way to think about it. You're either in the exception, you hit every mark or you're out of the exception. Anti-kickback, we need to look a little bit more at the intent. What are the parties doing? Are they intending to induce referrals or are they intending to pay for referrals when we start looking at the non-compliance.

CJ: Great discussion so far, we're at a point we're going to take a quick little break and then we'll be right back to talk some more with Hal.

Welcome back everyone from the break. We're speaking with Hal McCard, an attorney and expert in compliance with financial relationships with physicians and on that topic of compliance, Hal, if we could, how can, you know, we're speaking to our audience is predominantly compliance officers and they're doing compliance risk assessments and developing plans. How can they in a practical sense, use their compliance risk assessment and develop plans to address these risks that we've just talked about?

Hal: Well, I think the planning of it itself or the incorporation of physician relationships as a significant element of risk in any compliance program is extremely important and I think from the from the compliance standpoint, when we're looking more at how are we going to ensure these compliant relationships, I think the first area or one area that we want to look at initially is our contracting process, how do we bring these relations if we're on the hospital side, how do we bring these, how do these relationships get into our system? Is it through a medical staff development office? Is it through the executive suite? Are they, you know, depending on the size of our system, it's going to be handled in a number of different ways. But I think the most, or the initial part of the inquiry is to identify where these financial relationships enter our system, and how do they enter our systems? Is it through physician recruits? Is it through physicians coming to the, you know, just coming to the area and joining the medical staff and let's say we need a medical director for gastroenterology, are we going to enter into a medical directorship with that person who's doing the initial talking with that doctor about the medical directorship is our Chief Medical Officer. So, first point of inquiry might be to ask ourselves, how are these financial relationships entering the hospital or the health system?

And don't forget leases as well, these are often times we lease space to physicians. And STARK also has an exception related to space and space leases and equipment leases and things like that as well. So that's another part of the relationship. But first level of inquiry, how are they entering, what is the process by which we document these? Does it start out, where does it start out, does it go through legal and then compliance? Do they come to compliance and go through legal, so what does the contracting process after it leaves the medical staff's responsibility to business responsibilities? What's the process by which we do that? How do we document fair market value? Once we initially document fair market value, are we refreshing that on an appropriate basis if we have a one-year contract that renews, are we doing it every time on renewal? I'm not going to suggest that you need to update a fair market value study necessarily every year. So, say you have a three-year contract, it might be appropriate if it initially meets fair market value might be appropriate to do it at the end of the three-year contract, but what is our process for ensuring that these don't fall out of compliance in terms of fair market value? So, we look at our system for confirming fair market value. Then we look at our system for ensuring that these arrangements stay up to date and don't go out of compliance because of expiration. And do we have an electronic contract system depending on size and budget that's in rural hospitals that, you know, we track through Excel spreadsheets still because the software is a little bit out of reach, but the important point there is that we have a system that is repeatable and auditable and that's something that we can monitor and someone's responsible for doing it on a regular basis, which is another thing that comes out of the general compliance program guidance that we haven't identified individual who's responsible for keeping up with those areas of compliance. So that might be one way to look at it in the over overall enterprise risk assessment.

Billing issues, you know, probably outside the scope of the time we have today, but certainly auditing and attention being paid to those maybe as part of the regular audit plan. Because billing, you know, certainly billing issues, they will piggyback on any contract non-compliance issues and make them worse if you will because then we get into the real serious overpayment territory. So, that might be an approach to, you know, I tend to look at things systematically, I ask where does it come from? How does it get to us and where it is? And then how do we pay attention to it? Monitor it, audit it, and then make sure we're in compliance with it.

CJ: Yeah, in all those areas and steps you just mentioned, you know, there's what I've experienced is usually need to have processes written down, right, flow charts, you know, like you're saying, where does it go first, you know, and then after compliance or after legal, who gets it? And I really appreciate you mentioning just kind of the beginning step of how are these relationships coming to the organizations attention, right? So, and this is where I always talk about the importance of having a seat at the table. If you're in kind of a high, the chief compliance officer should be in those business strategy meetings when they're talking about recruitment, and you know, how does a system fill the need of, you know, particularly difficult recruitment, specialty, right? And are people getting quote — unquote creative. Let's get creative. Let's think outside the box, and you know those types of things, that's not bad as long as you've got people who can keep you in the guardrails.

Hal: Yeah!

CJ: You know, because people sometimes call things different things they come up with new words and they think they've invented some new strategy, and it's really the same old, same old you. And I've been doing this for 25 years and people still are getting into trouble for STARK and Anti-kickback, but they just, they called the new strategy something different.

Hal: Yeah, exactly! And to your point, I mean it is part of building a culture of compliance and we've all encountered the business folks who want to be out there and want to be aggressive and want to be productive and that's their job and they should be doing that.

CJ: Exactly!

Hal: But within the culture of compliance, as you point out, it's important for them to understand, you know, what the limits are as well as understanding what the processes are for making sure that all they're good, you know, they're good, hard work out in the field to bring physicians to the system, that's the nature of what we're dealing with. We're to bring high quality medical direction to the system or to the hospital, is conducted within those, especially on the Anti-kickback side, I think before it gets put down on paper, the Anti-kickback issues I think are extremely important and as you point out, very important to get that upfront address that upfront and have compliance be a part of that conversation.

CJ: Yeah, you know, and I've seen trainings important, right, especially when you maybe you get new sales marketing folks coming into organization and maybe they're coming from another industry, you know, things that you can do in other industries like open the bank account with this online bank and we'll give you $500 or, you know, open a new restaurant and we'll give you some free meals. Some of those freebies and incentives that work in other industries might not work in healthcare and often don't. And so you just, you know, got to be careful with that. And so I think training folks that might not be aware of just kind of this culture of compliance in healthcare that just exists this enforcement environment.

Hal: Yeah, absolutely! And this training should be part of every day one orientation, regardless of whether you're orienting new employees who are going to be working in physician practice development or whether they're in the financial Office or whether they're in housekeeping or wherever they are to reinforce the point that healthcare is different, as you point out, it's not that we can bring a doctor in and randomly give that doctor a thousand dollars, here's a thousand dollars stipend for something, you know, just something. I mean, unless they're employees and it's part of compensation when the fair market value exception requires payment for services performed by the doctor, so we're not paying physicians for things that are not services or things that they aren't doing and that's something that a lot of people miss, they do, they eventually do.

CJ: And you mentioned at the beginning kind of this word remuneration and how broad that is and a lot of us think; "Oh no one wakes up in the morning and thinks how am I going to get an envelope full of cash to this doctor in the alleyway at 1:00 AM," that sure that might happen, but it's mostly things of value, right? That might not be cash changing hands, that always feels a little suspect, but you know, like you said, you know, lease arrangements, other things that are things of value that people need to watch out for.

Hal: Yeah, it's a great point. I think that they have an exception for incidental medical staff benefits, non-monetary compensation and their limits on it. So, there are exceptions that we can fit into if we want to do some things like that, give a nice luncheon or holiday luncheon at Christmas time or do provide certain things in the Medical Staff Office or things like that, so we can do some of that, but you know we can't put everybody on a private jet and fly them to the beach for the weekend, that's probably not going to fly, so to speak.

CJ: Yeah! And to that point, you mentioned some of these other areas that we should be watching out for and you mentioned open payments, I used to be chief compliance officer for a medical device company and I was there just as open payments was getting instituted and so we were creating this program and those open payments, that database is a wealth of knowledge if people aren't using it, you know it'll tell you with travel, it'll tell you where they traveled to. And so, you know, you can mine the data and if you're seeing travel to places that you wouldn't suspect your physicians to travel to, again, that doesn't necessarily mean there's anything wrong, but has that been disclosed? Conflict of interest forms that you know those types of things have been shared and have been monitored and worked through. So, any other thoughts that you have on open payments, I mean that's one thing that I've looked at in many different aspects cause I was the director for conflict of interest program and so there's some overlap here.

Hal: Yeah, we always looked at open payments mainly and for most all of the physicians, but especially for any physician that's in a position in medical leadership who's in a position to influence purchasing decisions, who's in a position to influence any of the decisions that are being made by the hospital or recommend or suggest, you know, item services, orthopedic implants, you know, probably are the biggest, one of the biggest items. But it's important knowledge to avoid that, even the appearance of a conflict of interest because these are also available to the media these databases.

CJ: Exactly!

Hal: So, as we're thinking about reputational, you know, reputational harm and protecting against that in our enterprise compliance risk assessment, you know, we think about reputational harm as well to our hospital or to our health system and you know, having things like that, even if there is no actual conflict, having the appearance of an improper influencing of the decision making that, avoiding that I think is always a good thing to do.

CJ: Exactly! Well, Hal, we're getting a little bit closer towards the end, but I wanted to ask one more question if we have time, you know, we've got compliance officers listening to this, let's say they're doing all these things and then they discover some sort of issue of non-compliance in a physician relationship, general guidance or specific whatever you feel comfortable giving, what should a compliance officer do in that situation?

Hal: Well, the first thing I think, CJ, is a robust investigation of what, identification of the type of problem that it is., you know, does it implicate overpayments? So, let's say it's an expired agreement, you know, is that going to cause us trouble in the recent STARK revisions in the sprint to sort of regulatory modernization that occurred, it's probably been three or four years ago now, there was a little bit of loosening of the strict requirements of a writing in some cases or an expansion of the definition of what constitutes a writing, if you have an expired contract. So, I think the first thing to do is try and identify as specifically as possible what the actual problem is it just an expired contract? Can we cover it and can we address it in some other ways? And then the second stage after that as well if we can't get out, if we can't make an exception fit, do we have an overpayment problem? And then just on the STARK side there and OIG offers obviously the self-disclosure protocol on the STARK side and DOJ offers an Anti-kickback self-disclosure protocol as well.

So, there are ways to once the facts have been assembled, the overpayments if any have been calculated. The exact nature of the problem identified and also the remedial actions taken that it's not, I don't think it's enough anymore just to say; "Hey we did this wrong." But I think if it's going to be reported, there's going to be an interest in how is it corrected. That's certainly a part of any self-disclosure. What steps we're taking to try to remediate the problem? So we need to be thinking about remediation just even from the very beginning as we're working through what the exact nature of the problem is, so just a comprehensive approach I think to identifying those problems in a robust auditing and of these types of relationships. And I think that's the best we can do when we encounter non-compliance is figure out what happened to fix it and hope, you know, or find a way that it won't happen again.

CJ: Yeah! And I'm assuming you and your firm do that help clients with that type of thing probably all the time, right? When they've discovered some non-compliance, they know it's a little bit heavier and there's going to be some repayments. It's probably good to have some good counsel.

Hal: Yeah, we do. Absolutely! And there are things just on the legal side that we may and not because we're trying to hide anything, but we do as lawyers, we have access to the attorney-client privilege. So if there are, you know, if there are in terms of the advice that we give and the recommendations that we make, some of those communications are privileged under certain circumstances and if the investigations at the direction of the attorney, there's a substantial probability that that elements of the investigation will also be under the privilege. So, that's a tool, it's simply a tool to use, like I said not because we're hiding anything, but because we want a full and complete and robust investigation and then assemble the information and then and then figure out the best way to present it, or if we just need to, you know, repay the intermediary the if we need to repay the FI, we'll just repay the FI and move on. So yes, absolutely!

CJ: Well, Hal, that is wonderful advice. We've covered a lot of the topics. Any last-minute thoughts or you know we've talked about or anything else that's kind of on your mind in the space of healthcare compliance before we end up here?

Hal: Yeah! No, thank you for the opportunity. It's been an absolute delight to be able to talk to your audience today about these various and sundry issues. As we mentioned, we have a lot of experience in this area and I have a lot of experience, some of it painful.

CJ: Yes!

Hal: From my years of being in-house counsel and outside counsel as well. So we just appreciate the opportunity to be with you and your audience today and hope everybody has a wonderful day.

CJ: Well, thank you so much, Hal! And thank you to all our listeners for listening to another episode of Compliance Conversations. I'll make the invitation I always make. Please share this with friends and colleagues, if you know of a topic that we haven't covered in a while, or maybe you want a deeper dive into something, please reach out to us and let us know that, and if you know of anybody, like Hal, that's a good guest that you might think might make a good guest, we'd love to consider them as well. So, thanks for all your support, and have a great day, everyone!