Deeper Than the Headlines: Grant Non-Compliance

A little over a month ago, I blogged about the OIG guidance regarding compliance requirements and risks associated with grants. Recently, the OIG posted an audit report that drills home the point that grants compliance is definitely an area that your compliance program should be addressing.

The recent audit report was for work done by the OIG regarding the not-for-profit organization, Henry J. Austin Health Center, Inc. (HJAHC). HJAHC received $8.3 million in grant funds from the Health Resources and Services Administration (HRSA) through several Community Health Center Program grants to provide comprehensive primary care services in the Trenton, New Jersey, area. $281,000 of this amount was to support certain activities (i.e., one-time equipment purchases).

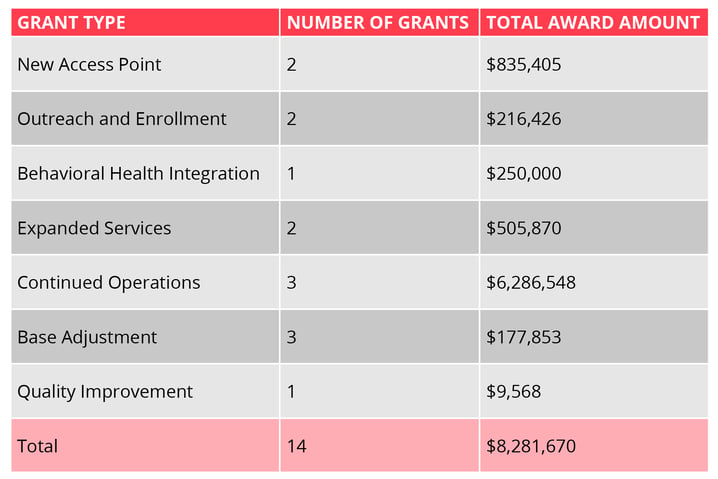

HRSA awarded HJAHC a total of $13,658,186 in Community Health Center Program funding for the period April 1, 2013, through March 31, 2016, including supplemental funding of $8,281,670 for expansion and continued operation of HJAHC’s Community Health Center Program. The table below summarizes the award amounts for the supplemental funding.

HJAHC’s Supplemental Community Health Center Program Grants

According to the OIG, HJAHC did not comply with Federal requirements related to its Community Health Center Program grants. Specifically, HJAHC did not track and account for grant expenditures separately from other Federal and non-Federal operating expenses, did not reconcile actual grant expenditures to its approved budgeted amounts used to draw down Federal funds and did not maintain documentation that supported grant expenditures for certain activities.

As a result of the audit, the OIG concluded they could not determine whether $8 million in costs claimed by HJAHC for certain Community Health Center Program grants were allowable. In addition, HJAHC claimed costs totaling $243,000 for certain activities that were unallowable.

OIG stated these deficiencies occurred because HJAHC did not maintain a financial management system that provided for accurate, current, and complete disclosure of the financial results of its Community Health Center Program grants, including:

- separately tracking and accounting for these grant funds,

- a comparison of expenditures with budget amounts for these grant awards, and

- maintaining records that supported the distribution of employees’ salaries and wages among specific activities and all expenditures charged to grant awards.

For example, the financial management system of each grantee must provide accurate, current, and complete disclosure of the financial results of each Federal award or program. The grantee’s records must identify the source and application of funds for federally funded activities and be supported by source documentation. In addition, grantees must record all grant award payments in accounting records separately from the records of all other funds, including funds derived from other grant awards.

HJAHC did not track and account for its Community Health Center Program grant expenditures separately from other Federal and non-Federal operating expenses according to the OIG.

Another example involved salaries. For salaries and wages to be allowable for Federal reimbursement, grantees must maintain monthly after-the-fact certifications of the actual activity for each employee working on Federal awards.

Charges to Federal awards for salaries and wages must be based on records that accurately reflect the work performed. The records must support the distribution of the employee’s salary or wages among specific activities or costs. The grantee’s system of internal controls should include processes to review after-the-fact interim charges made to a Federal award based on budget estimates. All necessary adjustments must be made so that the final amount charged to the Federal award is accurate, allowable, and properly allocated.

Based on this audit work, the OIG recommended that HRSA:

- Require HJAHC to refund $8 million to the Federal Government or work with HJAHC to determine what portion of these costs claimed to the Community Health Center Program grants were allowable.

- Require HJAHC to refund $243,000 to the Federal Government for unallowable costs. They also made procedural recommendations.

HJAHC disagreed with the OIG’s findings related to its tracking and accounting for grant funds and claiming of personnel costs. HRSA concurred with the OIG recommendations. Specifically, HRSA agreed to work with HJAHC to determine what portion of the $8.2 million claimed to the Community Health Center Program grants were allowable and if necessary, require a refund. In addition, HRSA stated that it has been working with HJAHC to improve its financial management system and practices.

If your organization receives grants, make sure to have compliance procedures in place to assess compliance with grant requirements.

Questions or Comments?