Deeper Than the Headlines: Medicaid Fraud Control Units

compliance, OIG, Medicaid, medical billing fraud, healthcare billing fraud, deeper than the headlines, healthcare fraud, medicaid billing fraud, fraud, CIA, Medicaid Fraud, federal false claims act, Medicare Fraud Strike Force, Medicaid Fraud Control Units

If you were looking for a sound financial investment, what kind of return on your money would you consider good? 8%, 10%, 20%? How about 652%!! If you could find such an ROI, wouldn’t it be amazing?

Well, it appears that the Medicaid Fraud Control Units (MFCUs) are such an investment according to the newly released annual report posted by the OIG. The report states that MFCUs return $6.52 for every $1 dollar spent. This equates to approximately $1.8 billion in recoveries for the fiscal year of 2017 ($1.1 billion in civil recoveries and $693 million in criminal recoveries).

The function of MFCUs is to investigate and prosecute Medicaid provider fraud and patient abuse or neglect. Currently, 49 States and the District of Columbia operate MFCUs, which are funded jointly by Federal and State Governments.

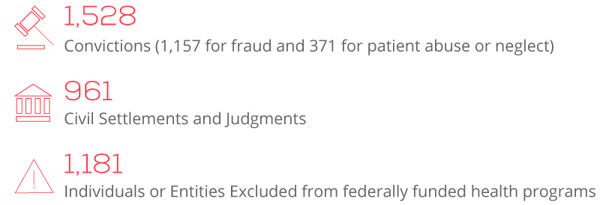

The report also provided the following statistics:

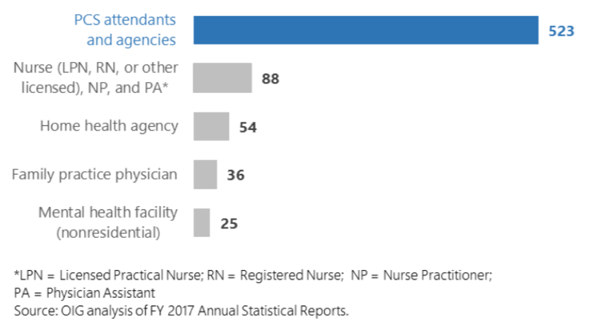

In addition, the OIG stated that significantly more convictions for fraud involved personal care services (PCS) attendants and agencies than any other provider type in FY 2017. Of the 1,157 fraud convictions in FY 2017, 523 (45 percent) involved PCS attendants and agencies. The exhibit below drills down deeper into the provider types involved in these fraud convictions:

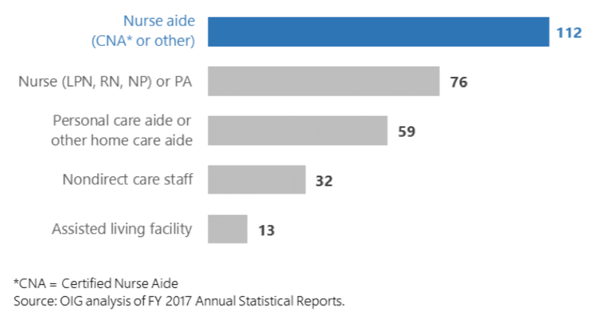

In regards to patient abuse or neglect, more convictions involved nurse aides than any other provider type in FY 2017. Nurse aides accounted for 112 of the total 371 patient abuse or neglect convictions (30 percent).The exhibit below details the provider types with the most convictions for patient abuse or neglect.

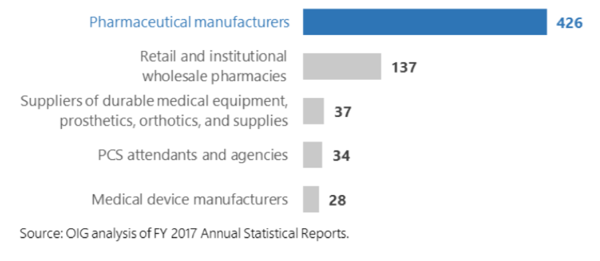

Of the 961 civil settlements and judgments in FY 2017, 426 (44 percent) involved pharmaceutical manufacturers. In one example, a pharmaceutical manufacturer entered into a settlement for knowingly misclassifying its drug as a generic drug to avoid paying rebates owed to Medicaid, in violation of the Federal False Claims Act. This pharmaceutical manufacturer entered into a $465 million settlement and a Corporate Integrity Agreement with OIG that requires an annual review of the company’s practices related to the Medicaid drug rebate program.

The other common provider types involved in civil settlements and judgments is provided in the exhibit below:

The report also provided an appendix that summarizes MFCU practices which OIG highlighted as beneficial to MFCU operations. They recommend MFCUs to consider whether adopting similar practices in their states may yield additional benefits. Reviewing this appendix gives compliance officers an idea of how much more thoughtful and sophisticated MFCUs are becoming. In addition, they are learning to more effectively coordinate with other agencies and offices. See examples below:

California

The MFCU hired a field representative to provide outreach and increase the number of fraud referrals sent to the unit. The field representative acted as a liaison between the unit and other state agencies and also trained staff from these agencies about Medicaid fraud and the unit’s role in combating provider fraud and patient abuse or neglect.

Florida

Unit staff has workstations in an OIG field office, which improved communication and cooperation with OIG on joint cases, including fraud cases generated through the U.S. Department of Justice’s Medicare Strike Force.

Michigan

Unit management and the Michigan Department of Licensing and Regulatory Affairs (LARA) developed a streamlined process for referring cases of patient abuse or neglect. This process helped to ensure that referrals from LARA were consistent with the unit’s statutory functions, thereby promoting efficiency and case flow.

New York

The unit developed a list of individuals and entities associated with ongoing investigations and by sharing it with the State Office of the Medicaid Inspector General, facilitated communication.

The unit established an Electronic Investigative Support Group composed of staff dedicated to providing technical expertise as needed throughout cases. For example, the group provided data analysis and tools for conducting undercover surveillance activities, which helped to improve the efficiency of investigations.

Utah

The unit required all unit auditors and investigators to become trained as Certified Fraud Examiners. This training helped the unit improve the efficiency and effectiveness of its provider fraud investigations.

Scrutiny from MFCUs is improving. Often times, compliance programs can become so focused on Medicare and other national programs, that they can lose sight of the enforcement activities at the state level. Reviewing this OIG report on MFCUs might be a good start at creating some focus on state and Medicaid initiatives.

Questions or Comments?